|

August 2005,

"Kewpies of the Month"

Jane Fleeman

1965

- Jim Crowell 1965

Biography

Jim and I graduated from Hickman in 1965. I went to Stephens College for two years and then to the University of Missouri. We both graduated from the University in 1969. We moved to Hannibal, Missouri soon after we graduated and lived there until 1985. While we were in Hannibal, we purchased a garden center which kept Jim busy, and I taught Algebra in a Junior High School. Both of our children, Brent and Sarah, were born in Hannibal. Brent is now 30 and Sarah will turn 26 in August. We now have five grandchildren; ranging from the ages of 10 months to 13 years old. In 1985, we moved to Virginia

Beach. We own Atlantic

Garden Center, which now has 2 locations. Several years ago,

I retired from teaching and started working at the garden center full time.

I run the gift shop and love working (and buying!) for the store.

Our children also work at the garden center. After Sarah graduated

from the University of Georgia, she came

to work for us as the Chief Financial Officer; her husband, Christian is

our General Manager, and Brent is the VP of Marketing. Having the

kids work the stores leaves us a lot more time to relax and travel, even

though it is still sometimes hard to get away!

Jane Crowell

See Story of Atlantic Garden Center

The little

A lot of retailers play the "If only" game. If only retailer Joe had enough money to build a stare-of-the-art greenhouse, sales would soar. If only retailer Joan could afford to pave the entire plant yard, her customer count would spike. Jim and Jane Crowell, owners of Atlantic Garden Center in Virginia Beach, Va., have the same handicaps many small garden centers do, yet shoved aside the if-only mentality. Not only do their sales soar without the dream structure and accompanying bells and whistles, but the Crowells are those rare retailers who are debt free. The restraints the Crowells operate under are not minor. They have an old, poorly ventilated building that their landlord refused to allow to be torn down at their Great Neck Road location. They have no loading dock or receiving area, so a cramped corner of the 44-space parking lot must serve those functions. Yet Atlantic Garden Center still managed to pull in $3 million at that single store in 2004. It's that stop that earned Atlantic Garden Center the 2005 garden center Innovator Award, sponsored by Garden Market Expo. At

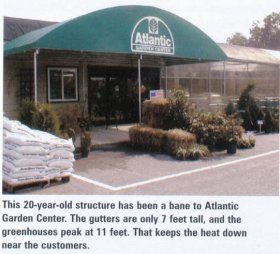

the mercy of the landlord

Most garden centers have 18-20 feet at the green-house peak, Jim said. The building hasn't been the only limitation for the Crowells. The building is on only 2 acres, with 44 parking spaces and no loading dock or receiving area. Delivery trucks must pull in alongside customers, and receiving takes place in the parking lot. "We do have a corner of the parking lot that we try to get the trucks in, where the bulk mulch is," Jim said. The obvious answer would have been to tear down the old structure and replace it with a more functional one. But landlords would not allow the Crowells to tear down the old structure, even at their own expense. "They wanted me to operate in the old building," Jim said. "I think they wanted to make life uncomfortable for me so they could make way for grocery stores when my lease was up in 2007." Luckily for Atlantic, after the Rite Aid chain made a splashy show of buying up land, the chain went broke. "The landlords realized that little old Jim has been there since 1991 and hasn't missed a payment," Jim said. The Crowells recently signed a lease to secure the property through

2022. They will soon realize their fondest business wish and build

a new structure.

Learned

success the hard way

The business savvy it took to almost double the stores' income in five years did not come from an effortless brilliance on Jim and Jane's part. It came from hard-won lessons from years of struggle. The two Atlantic Garden Centers are on sites that originally held another garden center. Jim worked as a general manager at those stores in the mid-80s before he left to start his own landscaping business. In 1991, he was given a tip by a friend that he could buy the ailing garden centers for a good price. Jim and two partners bought the 10-acre General Booth store, then soon took over the lease of the Great Neck store and renamed the stores to their current name, Atlantic Garden Center. By 1995, Atlantic Garden Center had taken over seven stores. Atlantic had assumed the previous stores' debts and the Crowells had no line of credit to aid them in the unwieldy chain of seven stores. "We were just losing our fannies," Jim said. "A quarter of a million a year debt on the income tax return for two years in a row." The cards were stacked against them. "We were trying to keep up seven stores," Jim said. "And our line of credit was minimal, about $200,000. We owned very little, we were strapped for assets and were young." That's a deep hole for a retailer to climb out of. In 1996, after losing money for two years, Jim, as the controlling partner, decided to sell four of the seven stores. He dumped another store in 1997, ending up with the two he and his wife currently own. Jim began consolidating ownership about that time, too. One of Jim's partners decided to get out while he could and, in lieu of being bought out, arranged for his name to be taken off the loans. Three years later, Jim bought the other partner out. Once Jim shed the underperforming stores, he concentrated on getting

out of debt.

How

to deal with a financial crisis

In 1996, he also reduced his 250-person staff to 25 people working in

the three stores Jim still owned. "As we started getting the business back,

we started hiring more people back," Jim said.

Then Jim had to face the vendors he owed. "Primarily, I told them that I wanted to keep buying from them and told them I wanted to pay the debt and I didn't want to declare bankruptcy. They didn't want us to, either," Jim said. As important as communicating is, Jim had to follow through with his promises. "They charged us interest, and we never refused a payment, and didn't dodge them. They knew where they could find us. Sometimes our finance charges were $30,000 to $40,000 a year," Jim said. Another consequence of Atlantic's financial crises was that most of his vendors switched him to a COD status. And that turned out to be a blessing. "We could not get credit from anybody. In order to buy plant material, we had to pay COD, which was wonderful. Still to this day, anyone who will take a COD check, we take advantage of that. Makes life so much simpler," Jim said. Besides the assurance that the company is not accumulating debt, paying COD also gives Atlantic a supply chain edge. "People love selling us products. If I order $2,500 of hanging baskets, the suppliers sell to me first because they get the cash immediately. I may pay $25,000 on certain days for COD deliveries," Jim said. One of the larger debts Atlantic owed to a vendor was $300,000 due to Commerce Corp., which arranged an eight- to 12-month short-term note, with interest. Jim takes great pride that he was able to pay the debt off within six months. By being up front with his vendors and sticking with his commitment to pay them, Atlantic developed a strong reputation among suppliers. "I paid them off as fast as possible. I didn't hang anybody.

I didn't let any of the closed stores' inventory stand unpaid," Jim said.

Concentrate

on the customer Atlantic saw an enormous upswing in sales. From 1996 to 1997, sales went up $850,000 in the two stores that still exist. That's quite a surge considering that the gross sales for those two stores was a little more than $3 million that year. The sales improved because Atlantic began paying closer attention to customers. "We were scared to death we were going to go broke, and we did better," Jim said. "We were here to focus on the customers rather than the problems of money. People would ask: "When are we going to get more gerbera daisies?" So we made sure we would get on the phone so we could say, 'Tuesday.' We had to get it, pay for it and make sure they had it available to buy," Jim said. Atlantic invested in advertising, then paid a lot more attention to

customer requests after the ads brought them in. Success accelerated

from there.

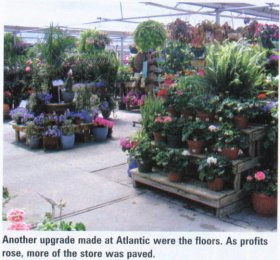

Controlling

profit

"We made quite a bit of profit, so we had to pay quite a bit of federal tax," Jim said. "Well, you know I love paying tax, but I'd rather do something else with our money." After doing so well, Atlantic got its line of credit back and Jim switched banks. With his new ability to maneuver, Jim decided he'd rather have his money go back into his company than have a large chunk of the profit eaten by taxes. "I asked: `Why don't we increase our mortgage?' We had 24 years

left on the loan [for the General Booth store], and of the $7,000 a month

we were paying, only $400 was going to principal. Ridiculous. We

went to $13,500 a month and paid off the mortgage in five years."

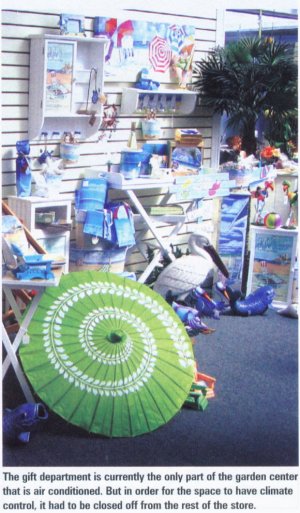

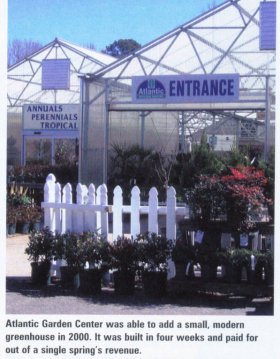

Having too much profit can be problem, taxwise. Atlantic learned its lesson from 1998 and has done several things to manage its money better. Along with increasing its mortgage payment, Atlantic began pouring the profits into upgrades. Replacing the older building was out, but there were several other ways the property could be improved. "Once I get to $100,000 net profit, I don't want to make any more money. So I start spending on the store," Jim said. "We started remodeling the gift shop, put in an automatic opening door. We installed air conditioning in the gift area, along with new lighting and carpet. Then outside the building, we put up new siding and poured concrete walks." Atlantic saw more than just a tax benefit from the upgrades. Customers began responding, too, and sales grew even more. "The customers see you doing these little things, and they're excited

for you and come in more often, buy more stuff. And they started

spreading the word," Jim said. "Spend more money, and you make more,

and you want to spend more. There are a lot of garden centers that

don't do a thing, and the customers realize that you're going the wrong

way, and they start wanting to shop at a place that paints and stays clean."

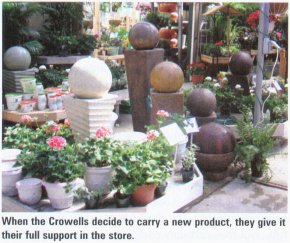

Inventory

control

The result is a healthy annual turn rate. "Our inventory turns are averaging six turns for the company, all the departments together. We're receiving an average of seven shipments a day, and 35 to 40 shipments a week during the season," Jim said. Atlantic places its orders primarily on Mondays, and shipments start arriving Tuesday, with the big delivery days falling Wednesday to Friday. Any plant that can be sold from a rolling rack is placed on one.

"We have about 40 racks that are on rollers that we float product on, or

sell off of if we need it right away. That's why we go with prepricing

- we can put it into the nursery to shop right off the racks," Jim said.

Fellow

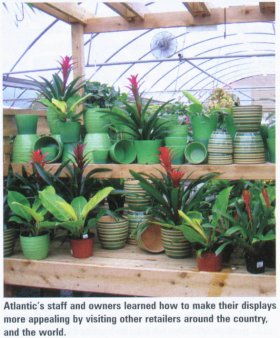

retailers and growers inspire growth

"Wayne Sawyer and I became friends at [Mid-Atlantic Nursery Trade Show].

He told me that he knew that we were doing better, but we still needed

to go to the [ANLA] Management Clinic. He said, `Why don't you go

with me So the two went to Louisville, where the Management Clinic is held each year. Jim made friendships and business connections there that last through today. "Ian Baldwin was speaking and gave a presentation with Joe Stoffregan [owner of Homewood Gardens in Raleigh, N.C.] and Scott Longfellow [owner of Longfellows Greenhouses in Manchester, Maine] and another retailer I can't remember at the moment. They had little show and tells, shared their average sales, showed how they spent little money in this and that. Ian had great charts, showing sales increases over five years." Jim realized how powerful shared information was. He learned about the summer ANLA retail tour and Baldwins English retail tour. He has attended many tours since then, and at any of them you will see him poring over the fnancials provided by host stores, and sharing any of his own with fellow retailers when it's called for. "I went on my fast ANLA tour in Baltimore, and that was amazing," Jim said. "To look at the Waterloos and Homestead Gardens was priceless. I started traveling a lot after that. I went to Chicago, where I met J and Linda Guy [of Novalis], and saw their benches at Sid's Garden Center and Chalet Nursery, and I started to pick up ideas on merchandising." At that first Management Clinic, Jim collected business cards from people

who have turned out to be instrumental in his current success: Baldwin,

Jeff Warshauer from Nexus Greenhouses, Gretchen Taylor with what was then

WIN, today's Independent Nursery Group (ING) and Kurt Fromherz from Sunrise

Marketing.

An

eye to the future

"Since the kids are involved, the whole thing changes. We want the new building," Jim said. And the new lease agreement with their landlords at Great Neck has given them the freedom to finally tear down the old structure. The facility at General Booth is just as old as the Great Neck store, but has higher ceilings, which makes the structure more usable. But even it will likely be rebuilt over the next few years. The strategy for building at the Great Neck location will be to install

a proper climate-controlled building, which the Crowells hope will increase

summer walk-in business. "I'd love to take those summer months and

drive the sales up. Maybe even doubling each month Also on the Crowells' dream list are automatic doors, which will cut down on dust. "It's cleaner, no fans drawing air through. Believe me, using fans to cool a greenhouse gets to be quite a challenge. We spend a lot of monev constantly vacuuming and dusting." For this goal, the Crowells are willing to take on debt, but they'll

probably enter a 10-year note to pay for the building rather than the standard

30-'year note.

For more:

Used by permission

of: "garden center" Merchandising & Management

Branch-Smith Publishing www.GreenBeam.com

|

Southern climates. "It's a greenhouse, gutter connected, with nine

3,000-square-foot bays - a 27,000-square-foot building," Jim said.

"Unfortunately, the gutters are 7 feet above the concrete floor.

That traps the heat so much closer to where rile customers are shopping.

Plus, there are no vents to let the heat escape."

Southern climates. "It's a greenhouse, gutter connected, with nine

3,000-square-foot bays - a 27,000-square-foot building," Jim said.

"Unfortunately, the gutters are 7 feet above the concrete floor.

That traps the heat so much closer to where rile customers are shopping.

Plus, there are no vents to let the heat escape."

next

month, and you can room with me? I'll introduce you to other people,

people who are positive influences."'

next

month, and you can room with me? I'll introduce you to other people,

people who are positive influences."'

on

a three- to four-pear period," Jim said.

on

a three- to four-pear period," Jim said.